Maximising financial insight: A deep dive into the operating expense dashboard

What is an Operating Expense Dashboard?

Operating expenses are not directly tied to the production of goods or services but are necessary for running the business, such as salaries, utilities, rent marketing etc. Managing operating expenses is important because it directly impacts a company’s profitability and financial health. An operating expense dashboard can be a game-changer in this regard. The dashboard serves as a centralised hub for monitoring, analysing, and optimising these expenditures.

Components of a Startup-Friendly Operating Expense Dashboard

Before effectively managing operating expenses, it’s essential to identify and categorise the 5 to 6 main expense categories that encompass all the operational costs incurred by the business.

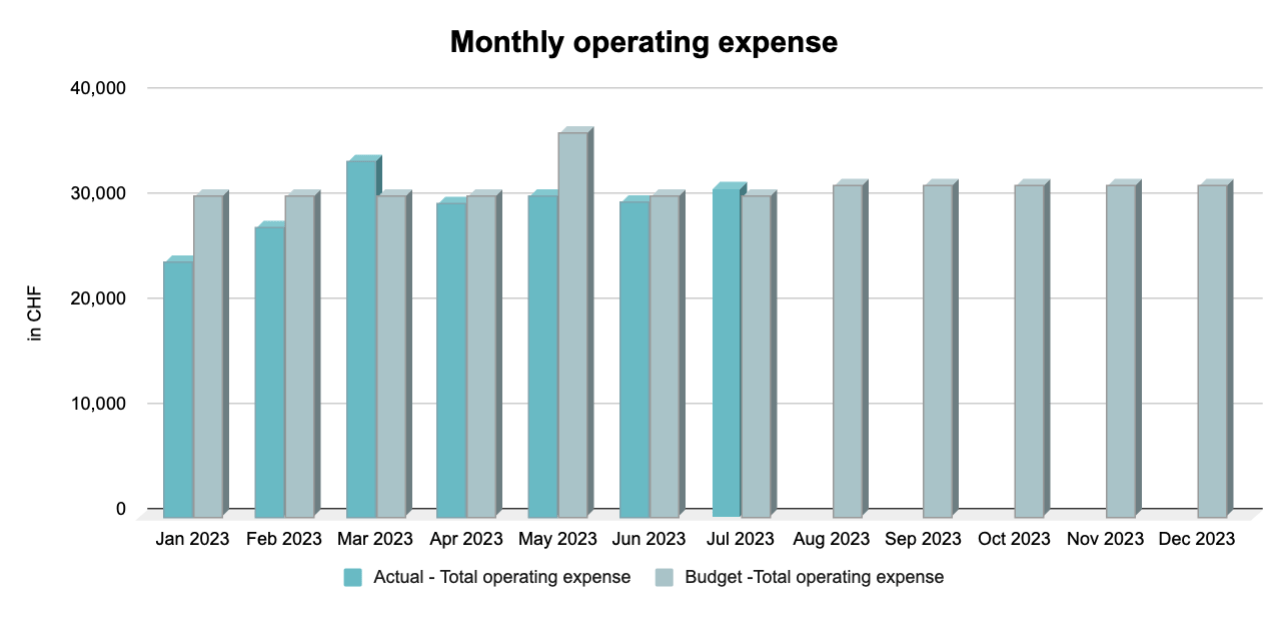

1. Operating Expense Actual vs Budget:

Month-by-month and year-to-date comparison of actual operating expenses against the budgeted amounts.It helps you assess overall budget adherence and the impact on your startup’s financial health.

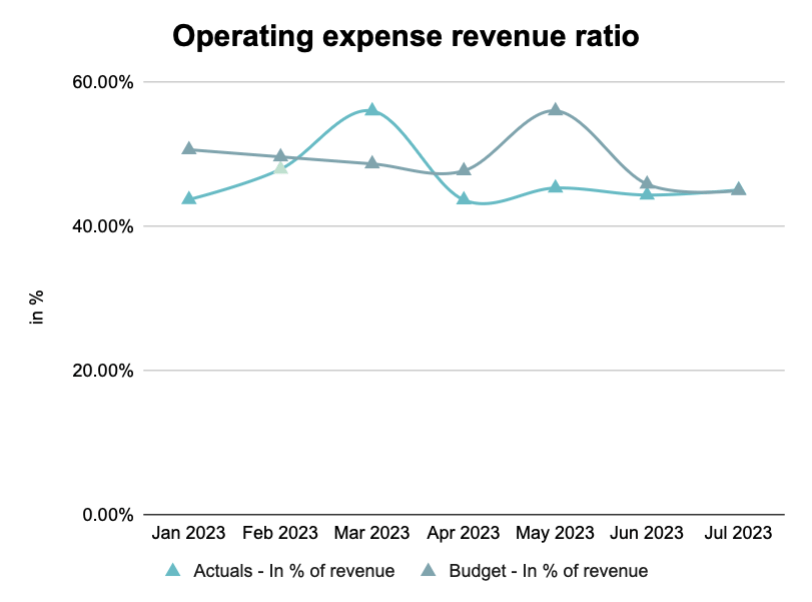

2. Operating Expense vs Revenue:

Ensure your expenses align with revenue generation for sustainable growth.

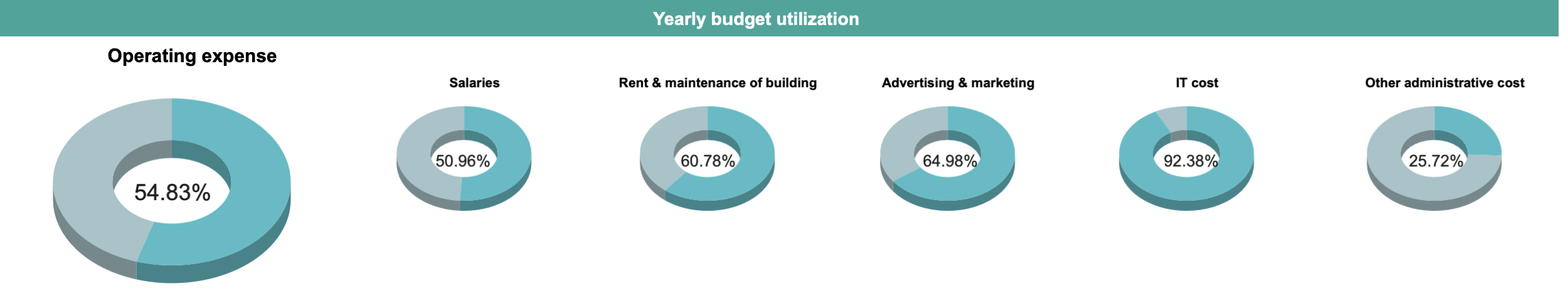

3. Yearly Budget Utilisation:

Monitor how effectively budgeted resources are utilised over the course of the year.By tracking remaining budget allocations for each main expense category, it guides businesses in optimising their resource allocation for maximum efficiency. Identifying underutilization and overutilization prompts a strategic reevaluation of spending priorities, ensuring a balanced financial strategy.

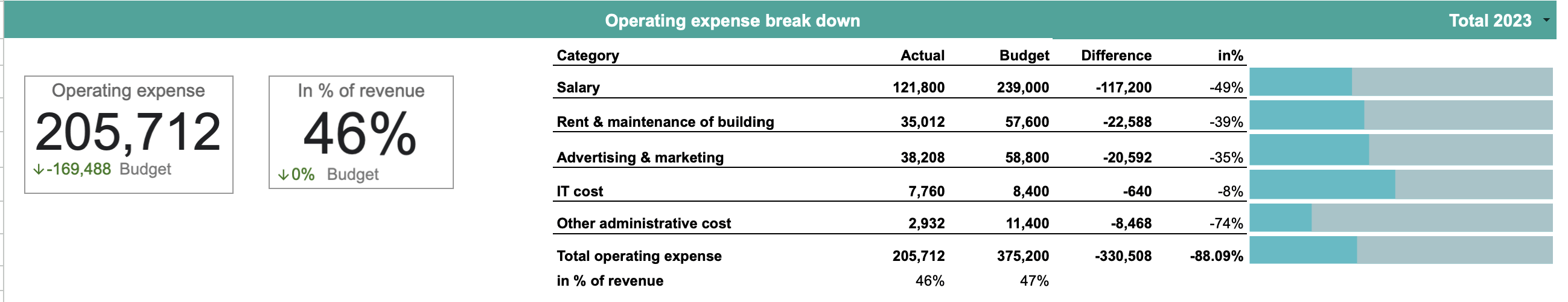

4. Operating Expense Breakdown:

This section provides a detailed analysis of actual versus budgeted expenses for each month. With the option to drill down into individual expenses, it enables a granular examination of spending patterns.

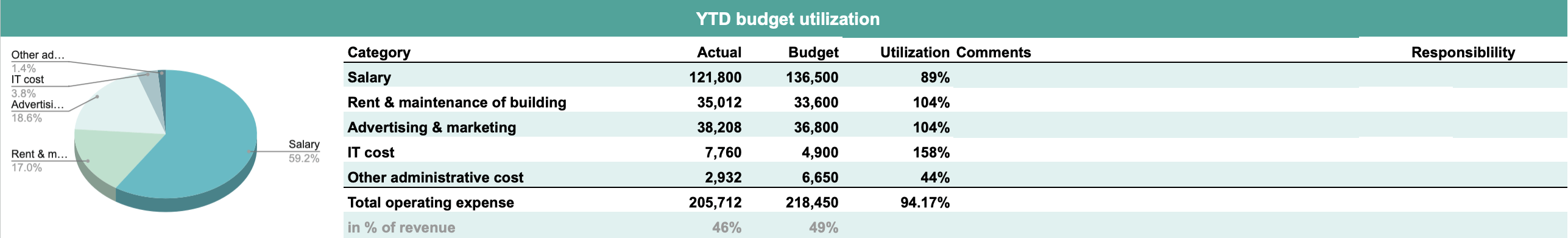

5. YTD Budget Utilisation:

Assesses the Year-to-Date (YTD) utilisation of the budget for each expense category with an opportunity for those responsible for managing each expense category to provide commentary on variations from the budget. This commentary enhances accountability and provides valuable insights into the reasons behind budget fluctuations, aiding in effective financial management and future planning.

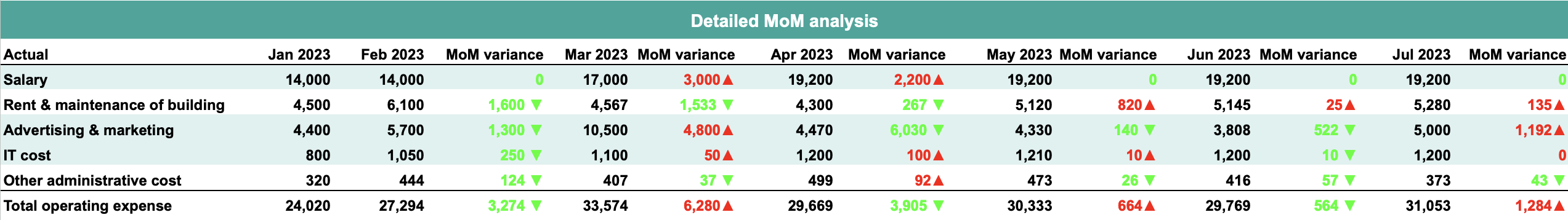

6. Detailed MoM Analysis:

Month-over-Month analysis reveals spending trends. For startups, this aids in understanding seasonal fluctuations and adjusting financial strategies accordingly.

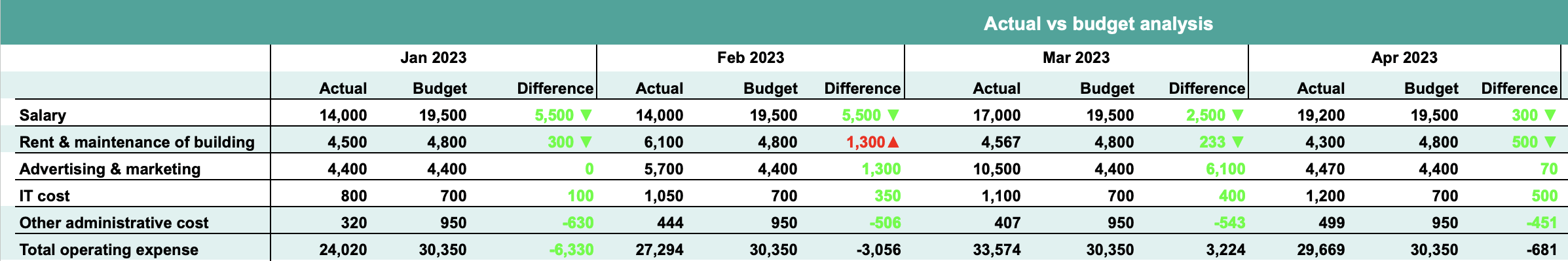

7. Actual vs Budget Analysis:

Compare actual expenses against the budget to pinpoint discrepancies. This assists startups in making agile decisions to align with financial goals.

In conclusion, as your business expands, consider advanced dashboards with cost centre and department-wise breakdowns. These dashboards serve as vital monitoring tools for management and powerful controlling instruments for respective departments. They empower businesses to allocate resources strategically, maintain budget discipline, and ultimately thrive in an ever-evolving financial landscape.