We simplify

Corporate Tax & VAT Compliance

Optimize tax compliance with expert Corporate Tax and VAT services for strategic advantage.

Simplify Tax Compliance

Managing corporate tax and VAT is complex but crucial for compliance and financial health.

At Scalemetrics, we offer tailored tax services that ensure your business remains compliant while minimizing risks.

Our approach also maximizes financial benefits, helping you optimize your overall tax strategy.

Why Choose Us?

Initial Assessment

We conduct a detailed initial review of your tax situation to uncover both potential risks and opportunities for optimization.

This evaluation allows us to accurately assess your current tax footprint and explore areas for potential cost savings or compliance enhancements.

Understanding these elements is crucial for developing a robust strategy that mitigates risks and maximizes financial efficiency.

Tailored Strategy Development

Based on the findings from our initial assessment, we craft a bespoke tax strategy tailored specifically to your business's unique needs.

This strategy encompasses all aspects of corporate tax and VAT, designed to leverage legal tax benefits while ensuring full compliance with the latest regulations.

Our goal is to align this strategy with your company's financial and strategic objectives, providing a clear roadmap for tax planning and decision-making.

Implementation & Compliance

Our dedicated team takes charge of implementing the tax strategy, managing all filings and documentation with precision and timeliness.

We ensure that every aspect of your tax strategy is executed flawlessly, maintaining compliance with tax laws and minimizing the risk of penalties.

This meticulous approach allows you to focus on your core business activities, confident in the knowledge that your tax affairs are in expert hands.

On Going Support

We continue to support your business with regular tax reviews and updates, ensuring your strategy adapts to both changes in tax legislation and shifts in your business environment.

These ongoing advisory services are designed to keep your tax strategy as effective and relevant as possible, helping you navigate the complex tax landscape confidently and with ease.

This proactive approach not only safeguards compliance but also optimizes your tax position continuously.

Start your VAT & Tax today and eliminate hassles effortlessly.

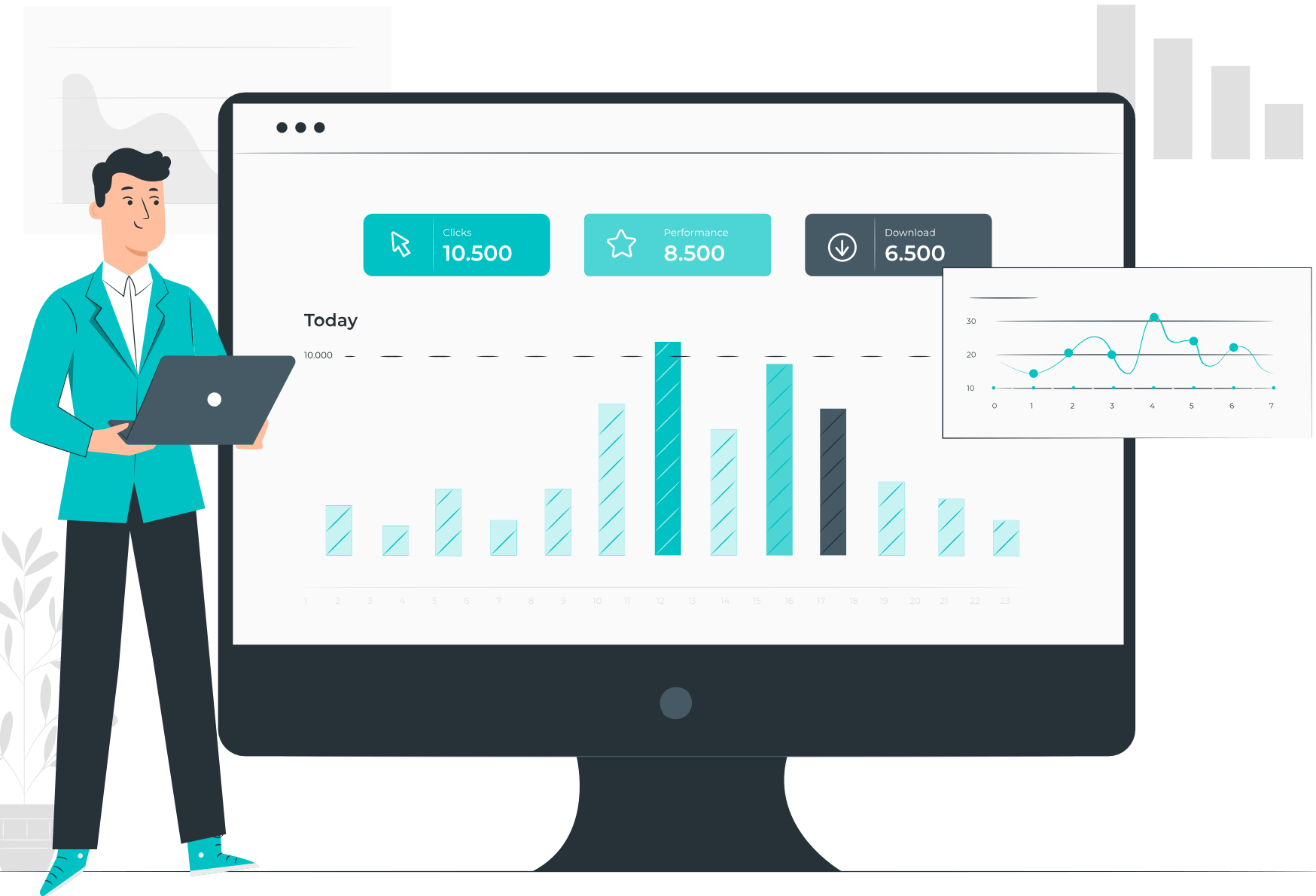

Pricing

Corporate tax preparation and filing

- Ensure timely, accurate tax filings.

- Guidance on tax efficiency and compliance.

- Plan and mitigate tax risks.

VAT registration and filings

- Handle VAT registration efficiently.

- Prepare and submit accurate VAT filings.

- Ensure compliance with VAT documentation.

Cross-border VAT compliance advisory

- Comply with international VAT regulations.

- Optimize processes for VAT recovery.

- Maximize VAT refunds to improve cash flow.

*Get in touch to explore our custom package tailored to your unique needs

What Our Customers Are Saying

Frequently Asked Questions

Switzerland's corporate tax system includes federal, cantonal, and municipal taxes, leading to varying rates depending on the business location. The federal corporate tax rate is uniform, but cantonal and municipal rates differ. For instance, cantons like Zug and Nidwalden offer lower rates, while Zurich and Bern have higher rates.

Value Added Tax (VAT) in Switzerland is a consumption tax levied on most goods and services. The standard VAT rate is 7.7%, with a reduced rate of 2.5% for essential items like food and medical supplies. Businesses with an annual turnover exceeding CHF 100,000 must register for VAT and comply with reporting obligations.

Foreign businesses engaging in taxable activities in Switzerland are required to appoint a fiscal representative to handle VAT compliance and communication with Swiss tax authorities. This includes registration, filing returns, and ensuring adherence to Swiss VAT laws.

Strategic tax planning, such as selecting a canton with favorable tax rates, utilizing available tax incentives, and ensuring compliance with international tax standards, can enhance tax efficiency and mitigate risks. Consulting with experienced tax advisors is recommended to navigate the complexities of Swiss tax regulations.

Non-compliance with VAT regulations can lead to penalties, financial consequences, and reputational damage. It's essential for businesses to maintain accurate records, submit timely returns, and adhere to Swiss VAT laws to avoid such issues.